Have you ever ever requested your self, “How a lot cash do it is advisable to retire comfortably?” In that case, you might be positively not alone, and that is what I’ve calculated many occasions!

This is without doubt one of the most typical cash questions I’ve heard and I totally perceive why. Resignation plans can really feel overwhelming, particularly if you see individuals throwing numbers like $1 million or $2 million. However the reality is, there isn’t any reply for all sizes.

Most significantly, your private life-style, spending habits and retirement objectives.

One of the best ways to calculate the quantity it is advisable to retire comfortably

On this article, you possibly can break this subject down into easy steps and begin determining your retirement quantity like stress, confused, or as a complete (retirement).

I like to recommend studying: Tips on how to Save for Retirement – Solutions to 13 of the Most Widespread Questions

1. Take into consideration “retiring comfortably” for you

Retirement, and even retiring comfortably, implies that it is totally different for everybody.

Earlier than you perceive the cash you want, you will need to first contemplate what a cushty retirement will appear like for you.

For some individuals, it means touring the world, occurring a cruise (e.g. an costly world cruise!), or spending the winter in a heat place. For others, it could imply lowering to a small house, having fun with hobbies like gardening and studying, or spending time together with your grandchildren.

As you possibly can see, retirement appears totally different to everybody.

Right here is an effective train – consider at some point of your dream retirement and the next questions: What time do you get up? What do you eat? Do you calm down, journey, or work part-time? Do you reside in the identical home or have you ever moved to a small house or a brand new metropolis?

Subsequent, write down what kind of bills you need to stay in. This helps you identify whether it is essential to kind of than the suggestions for a “normal” retirement quantity.

You can too create a listing of what you need after retirement, similar to journey budgets, serving to your youngsters and grandchildren, or sustaining a second house. Subsequent, you’ll construct your retirement plan on these core objectives.

2. Resignation guidelines for retirees (maintain easy)

There are a number of helpful guidelines that you need to use to estimate how a lot you could must retire. These are usually not good and I simplified this rather a lot, however they seem to be a good place to begin.

- 25x Rule – Multiply the anticipated annual price by 25. So if you wish to spend $40,000 a yr on retirement, it is advisable to save $1,000,000.

- 4% rule – This implies you possibly can withdraw 4% of your retirement portfolio annually with out being too quick. So in case you’re saving $1 million, you possibly can withdraw $40,000 a yr.

Effectively, I do know these two guidelines sound related, and that is as a result of they’re! The 25x rule focuses on how a lot you save in entrance Your retirement. In the meantime, the 4% rule focuses on how a lot you possibly can safely withdraw from retirement financial savings yearly after retirement.

Now I want to say that these guidelines will often work greatest in case your cash is invested and continues to develop throughout retirement (hey, compound curiosity!). If you happen to’re planning on dwelling your money financial savings by yourself, or if you wish to maintain the whole lot in a low curiosity account, you may want to avoid wasting extra as a result of your cash is not rising.

I like to recommend studying: What are dividends and the way do they work? Newbie’s Information

3. Estimate retirement prices

Figuring out how a lot you suppose you want is one factor, however realizing your prices is the place the precise plan begins.

Begin by monitoring your present month-to-month bills.

Divide it into classes like this:

- Housing: Hire/Mortgage, Property Tax, Dwelling Upkeep/Restore, HOA Price

- Utilities: electrical energy, fuel, water, web, phone, sewer

- Meals: Grocery and eating places

- Transportation: Fuel, automotive insurance coverage, automotive funds, repairs

- Well being: Insurance coverage premiums, prescriptions, self-pay, dentistry, imaginative and prescient

- Journey and enjoyable: Holidays, hobbies, leisure (listening to stay music, going to films, and many others.)

- People: Clothes, Haircuts, Presents, Subscriptions

Ask your self when you have got your present finances. Does this imply that you’ll enhance, cut back or keep the identical if you retire? I do know it is laborious to estimate now, however the first yr of retirement might look utterly totally different to what you thought in case you weren’t planning it.

Some prices will doubtless be decrease, similar to commuting, childcare or enterprise apparel. However others, like healthcare and journey, might go up. The quantity you spend on hobbies can enhance as you enhance your free time. Do not forget about inflation. {Dollars} right now won’t be bought 20 or 30 years from now.

I feel so many individuals spend much less on retirement, however that is not essentially the case. Many individuals spend extra money!

4. Do you retire and work or earn an revenue?

Not everybody desires to cease working utterly.

Actually, many retirees select to begin a facet job part-time, freelance, or once they retire. Even when it is just some hours per week, I feel doing what you’re keen on may also help you earn more money and make you content.

Listed here are some retired facet hustle concepts:

- Train music classes, non-public tutors, or babysitting

- We promote crafts and handmade objects on Etsy

- Freelance writing, bookkeeping, proofreading, and digital assistant work

- Working in a nationwide park, museum or store

- Please speak to the corporate

Even bringing $500 to $1,000 a month can enhance your financial savings and provide you with extra monetary freedom. You can too retire early or spend extra time.

I feel the nice job of this part is to ask your self. If that helped you retire earlier or journey extra, would you love to do a small quantity of labor if you retire?

I like to recommend studying: 17 Greatest Retirement Aspect Hustle

5. The place you reside the issue

Your location can have a huge impact on the quantity it is advisable to retire comfortably. It’s because dwelling in a high-cost dwelling space means it is advisable to save extra money so you possibly can afford your bills.

Some retirees select to:

- Transfer to a small home

- Transfer to low-cost states with no revenue tax (similar to Florida and Texas)

- Journey to a walkable group and never embrace automobiles (many cities supply free or considerably discounted public transport passes!)

- Transfer abroad to a rustic with low price of dwelling

For instance, individuals dwelling in San Francisco will want much more retirement financial savings than individuals dwelling in rural Tennessee. Even in the identical nation, whether or not it is housing, healthcare, meals, and many others., the whole lot could be very totally different.

6. Do not forget about healthcare

Healthcare prices are inclined to rise with age (and so they’re rising for nearly everybody anyway!). If you happen to’re not prepared, you possibly can eat a giant chunk of your retirement finances.

Medicare may also help you pay extra prices after the age of 65, however you do not pay all of them. You should still must pay:

- Self-pay and deduction quantity

- Dental and Imaginative and prescient Care

- Pharmaceuticals

- Lengthy-term care or house help

One strategy to plan forward is to make use of a Well being Financial savings Account (HSA) in case you are eligible. HSAs have main tax advantages. Your contributions are tax deductible. They develop up tax-free. As well as, withdrawing medical bills is tax-free.

I’ve a private retired buddy, however then I went again to work part-time (for a similar employer) and my household may have free medical insurance (the employer paid for medical insurance). So this is perhaps one thing to look into too.

I like to recommend studying: 15 part-time jobs with medical insurance

7. A software that can assist you perceive your retirement quantity

In case you are not a spreadsheet individual or you don’t want to make use of a monetary advisor, don’t fret. There are numerous free instruments out there that can assist you determine which quantity you left your self.

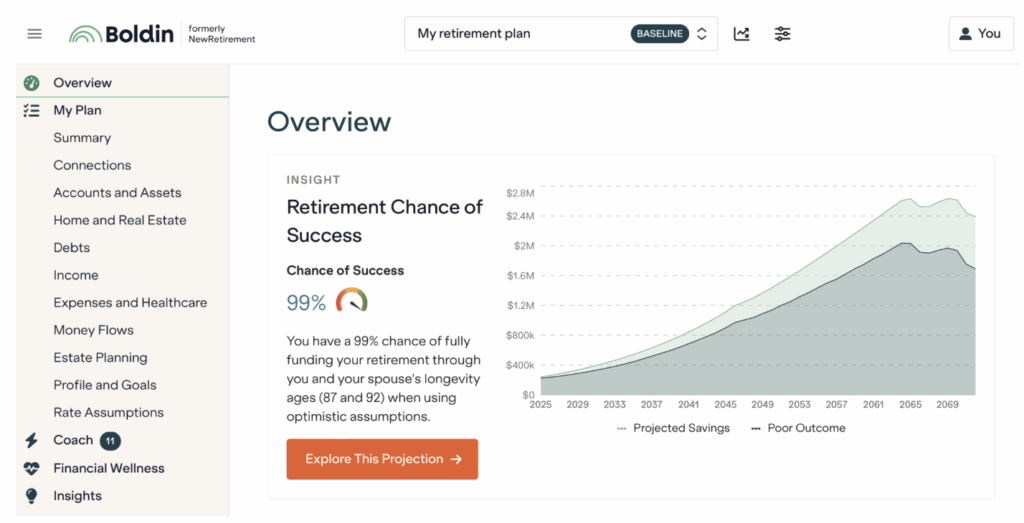

One well-liked software is Boldin. I just lately examined it and beloved how easy it was. You possibly can hyperlink your account or enter your revenue and financial savings manually. It should offer you a easy photograph of your progress in direction of retirement and even counsel methods to enhance your retirement plan.

Click on right here to launch a free Boldin account and use the retirement calculator and platform.

- Study the age you possibly can retire

- Take a look at your internet value

- Calculate estimated retirement revenue and bills

- Discover the most effective age to get social safety

extra.

One other frequent free choice for planning your retirement is Empower (which was referred to as Private Capital).

If you happen to’re not there but, it is nice

If you happen to learn this and suppose, “I am that late, I am going to by no means retire,” then know that you just’re not alone, and it is by no means too late to begin.

The essential factor is to begin right now, even when it is a small step like studying this text!

There are a number of different methods to get began:

- Improve your contributions from retirement

- Open Loss or 401(ok) or max

- Get rid of debt to cut back month-to-month bills

- Scale back your private home or automotive

- Discover methods to earn further revenue and make investments

- Discover part-time jobs after retirement that can assist you last more retirement financial savings

Now I need to say that you do not have to be good, and that it’ll assist you to in any method. The sooner you begin, the longer your cash has to develop, however beginning later can result in a cushty retirement.

So get began!

FAQ

Under are some solutions to frequent questions on tips on how to understand how a lot it is advisable to retire comfortably.

Can I retire at age 60 for $500,000?

This is determined by your life-style and whether or not you have got different sources of revenue, similar to Social Safety or pensions. If you happen to stay in a low-cost space and maintain your spending low, that is potential, however I feel it might probably at all times be deliberate!

Are you able to retire comfortably for $1.5 million?

Sure, for a lot of, that is sufficient in a retirement account, particularly in case you’re spending lower than $60,000 a yr. This quantity offers you flexibility, particularly if your private home is paid again and there are not any different money owed.

Is $300,000 sufficient to retire on Social Safety?

Particularly in case you stay in a low-cost space and have Social Safety advantages, it may be sufficient for a modest retirement. Nevertheless, you could must finances.

Can I retire at age 55 for $2 million?

In all probability sure! It actually is determined by how a lot cash you spend annually to know if $2,000,000 will comply with you. However for many individuals, that is greater than sufficient cash to save cash for retirement.

Is $40,000 a yr sufficient to retire and stay there?

Whether or not $40,000 a yr is sufficient to retire is determined by your location, life-style, and whether or not your private home is being paid again. Many retirees stay beneath this quantity, nevertheless it is determined by you and your spending.

What is an effective month-to-month wage after retirement?

A superb month-to-month wage is determined by many issues, together with your retirement life-style (need to journey? Do you have got costly hobbies?), the place you reside (California and Hawaii will often be costlier than Arkansas), and whether or not you have got money owed or not.

Can I stop with no mortgage?

Sure, and many individuals are planning their retirement about paying again their houses. And not using a mortgage, that is an awesome purpose, as month-to-month bills might be a lot decrease and it may make it simpler to stay on bonds with low bonds.

Do it is advisable to take inflation into consideration when planning your retirement?

sure! Costs for the whole lot, together with meals, housing, healthcare, and extra, rise over time. If you happen to want $50,000 a yr right now, you would possibly want $65,000 or extra over 10-15 years. So ensure that your retirement plans develop with inflation.

How a lot cash do it is advisable to retire comfortably? – abstract

I hope you take pleasure in my article on how to determine how a lot it is advisable to retire comfortably.

Personally, that is one thing I at all times take into consideration. For years I’ve created a life and enterprise that provides me freedom and adaptability. However retirement is past my coronary heart (at all times, to be trustworthy – I really feel that is regular for monetary professionals, HA). I particularly need to ensure that we’re financially free for the long run and perpetually.

There is no such thing as a precise retirement quantity that may assist everybody, so understanding your personal life-style, prices and objectives will assist you to create a plan for working.

For some individuals, that quantity could be $500,000, and for others it may be $5,000,000. I personally know individuals who have retired from every of those and few who’ve retired. And they’re all joyful!

What does your dream retirement appear like? Have you ever already understood your retirement quantity?

I like to recommend studying:

(TagStoTRASSLATE) Cash Administration (T) Resignation