Are you questioning if Boldin is the precise software that will help you plan your retirement? this Boldin Evaluation Decompose the whole lot it is advisable to know.

Monetary planning may be complicated and even scarier. So I used to be excited to check out Boldin (previously often known as New Retirement). Should you’re heading in the right direction, when you may retire, and the way to earn cash so long as attainable, this software is beneficial.

Boldin is completely different from different monetary instruments as he will get deep into his retirement plans. It is not nearly exhibiting web value or spending. This may make it easier to make sensible, long-term selections about social safety, taxes, healthcare, actual property planning and extra.

If you wish to take monetary planning in your individual fingers, I believe it is an ideal monetary software utilized by Boldin. Run eventualities to make higher selections and get extra management over your cash. You will get a full monetary evaluation, together with financial savings charges, investments and extra, and create a monetary plan that fits you.

Personally, I ended up spending just a few hours on the platform merely testing completely different eventualities, tweaking the knowledge I entered, and digging into the small print. It was enjoyable to see that small adjustments could make an enormous distinction to my retirement plan and I discovered it to be extraordinarily useful in visualizing the whole lot clearly.

Click on right here to attempt Boldin at no cost.

Boldin Evaluation

On this Boldin evaluation we’ll clarify to you what it’s, the way it works, who it really works, and for who it’s value the associated fee.

What’s Boldin?

Boldin is retirement planning software program that helps you create detailed monetary plans. It was initially launched as New Retirement, and in 2025 its title was modified to Boldin.

Boldin permits you to mannequin your complete monetary journey. This contains financial savings, bills, investments, taxes, social safety, housing selections, retirement, and extra.

It will possibly make it easier to reply questions reminiscent of:

- Are you saving sufficient?

- Do I want to avoid wasting or repay my debt?

- What number of homes can I purchase?

- When can I retire?

- Can I retire early?

- Will you run out of cash?

- Do I have to convert it to Loss?

- Can I afford to assist my children or give them to charities?

It’s constructed for on a regular basis individuals who wish to higher perceive cash and make smart decisions, with or with out a monetary advisor.

I made a decision to check Boldin as a result of I wished to seek out one thing that’s straightforward to make use of, useful and inexpensive for readers. After I heard that Boldin may construct his personal monetary plan with out hiring an advisor, I knew I wanted to present it a attempt.

What stood out to me was how detailed Boldin is. It is not nearly coming into just a few numbers. You may really construct a whole monetary roadmap, take a look at completely different life selections and see how they are going to have an effect on your future.

It is like having a robust retirement calculator, a monetary coach, and a tax planner multi function.

Are you able to see what your retirement plan appears like? Click on right here to create a free Boldin account. It can take only a few minutes to get began.

What does Boldin make it easier to do?

Boldin is about retirement plans and is extra than simply monitoring your investments.

Listed here are a number of the issues you are able to do with Boldin:

- Take a transparent image of your web value

- Estimate your retirement advantages and prices

- Optimize the optimum age to claim social safety

- Study loss conversion and tax planning

- Mannequin completely different housing selections, reminiscent of downsizing and shifting

- See how completely different funding returns will have an effect on your plans

- Planning healthcare and long-term care prices

- Predict actual property values and legacy objectives (how a lot cash is it that you simply wish to depart your youngster?)

- Run an in depth “what-if” state of affairs

Whether or not you are questioning while you’re leaving, whether or not you may journey extra, or whether or not it is protected to spend just a little additional, Boldin might help you discover the reply.

What I like about Boldin is that it is extraordinarily straightforward to make use of. You may spend 10 minutes coming into info into the platform and calculator, or spend hours working completely different eventualities.

Who’s Boldin?

Boldin is nice:

- Individuals planning to retire

- These thinking about tax, social safety or healthcare optimization

- Early retirements and followers of the hearth motion

- DIY Cash Managers who wish to keep away from excessive session prices

Actual folks use the platform.

- Resolve whether or not to retire now

- Mannequin the impression of shopping for a second house

- Discover the most effective time to claim social safety

- Planning medical bills throughout early retirement

Individuals say Boldin helps to really feel at peace, give him extra confidence and keep away from expensive errors.

How does Boldin work?

Boldin is a software that helps you construct your individual customized retirement plan. Create a free account in minutes and begin including info immediately.

To get began with Boldin, listed below are some issues it’s important to do:

- Join a free account on the Boldin web site.

- Enter your private monetary info, together with earnings, property, financial savings, retirement objectives, and bills. You may enter it just by coming into it or just by coming into it (there are over 100 knowledge factors that may be entered if vital).

- Use planning instruments to construct and customise your retirement plans. This contains including life occasions reminiscent of home discount, early retirement, and loss conversion.

- Discover the dashboard to view projections, evaluate what-if eventualities and make it clear in case your plans are on monitor.

One among my favorites about Boldin is how detailed and versatile it’s.

You may go as deep as you need, and you do not even have to hyperlink your account if you wish to enter issues manually. Good for individuals who plan their very own retirement and are assured of their future.

Boldin’s finest instruments

After utilizing the software myself, right here is the characteristic I believe is value it:

1. Comparability of what-if eventualities

Would you wish to know what occurs for those who retire at 40 as an alternative of 65? What for those who get Social Safety just a few years earlier? Or transfer to a different state?

You may create and evaluate completely different variations of your plans. Plus, each time you run a state of affairs or change your plan, you will get on the spot suggestions from Boldin.

I believe this can make it easier to make selections and perceive your choices.

2. Roth Conversion Explorer

This characteristic (a part of PlannerPlus – paid choices) helps you discover when and the way lengthy you wish to convert out of your tax deferred account to a Roth IRA. It appears at your tax and earnings forecast.

You may take a look at completely different begin/cease years, quantities and see the impression over time. This is likely one of the most superior loss conversion instruments I’ve seen.

3. Suggestions for enchancment strategies

Boldin sends alerts that will help you retire sooner and handle your cash higher.

For instance, you may get an alert saying, “Should you pay a further $250 monthly based mostly in your knowledge, you might be able to repay your mortgage earlier than you permit.”

These little sensible suggestions are extraordinarily useful!

4. Lessons and reside occasions

Boldin PlannerPlus customers can take part in reside classes to ask questions and be taught instantly from Boldin consultants. It is a nice approach to get assist and see how others use the software.

For instance, a number of the courses and occasions I am at present watching have a number of reside occasions every week, and a few courses which you can entry at any time):

- Elevating financially savvy kids

- Talk about funds along with your accomplice

- Purchase or lease a house

- 15 or 30 yr mortgage

- HSA Account Fundamentals

- Tax Planning

- Retirement Earnings Plan

- Actual Property Planning

5. Actual-time monitoring of particular person monetary conditions

Boldin permits you to take a fast snapshot of the place you might be standing and what it is advisable to do.

Sure, you may see your web value, and you may as well create a “watchlist” – I actually, actually find it irresistible. That is most likely considered one of my most favorite options on Boldin.

For instance, you may see you:

- Financial savings charge

- Resignation Financial savings Prediction

- Money circulate

- Earliest attainable retirement date

- Resignation countdown

- Complete debt ratio

extra. There are about 25 completely different metrics you may see.

What do you assume is your monetary success? With Boldin, you may construct your individual monetary plan and discover ways to higher.

How a lot does Boldin value?

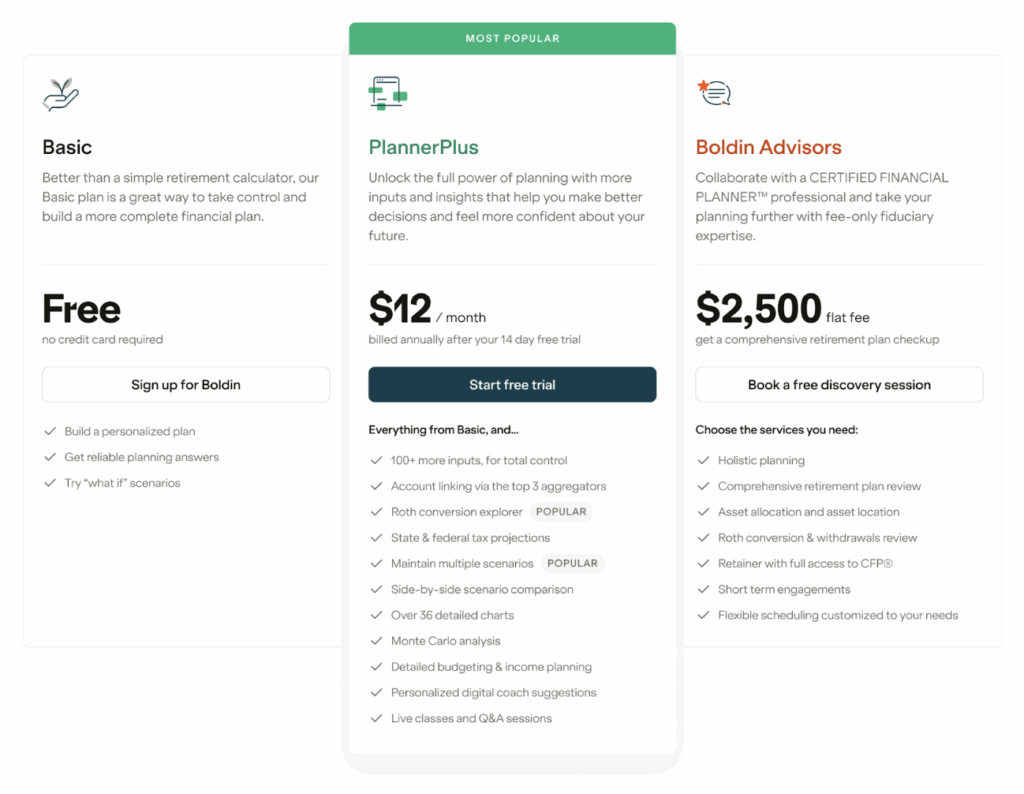

Boldin provides each free plans and paid plans known as Plannerplus.

- Free plan – Entry primary dashboards, some calculators, and easy projections. This plan is nice for those who’re simply beginning out and desire a fast overview of your retirement photographs. You may be aware of the platform and be capable of discover your funds with out spending cash.

- plannerplus – This plan prices $12 a month or $144 a yr and comes with a 14-day free trial. With PlannerPlus you may get the whole lot with a free plan. Moreover, all premium instruments can be found, together with loss conversion instruments, tax methods, detailed funds and earnings planning, reside courses, Monte Carlo evaluation (testing plans in opposition to danger), real-time web asset evaluation, a whole library of courses, weekly reside occasions, and the choice to hyperlink accounts for real-time updates. PlannerPlus is ideal for many who wish to implement a wide range of eventualities, optimize their tax methods, and plan healthcare and long-term care prices. The improve is unquestionably value it.

Which plan do you want?

- If you’d like a primary overview of the place you stand, follow the free plan.

- Should you want detailed insights, highly effective instruments, and ongoing assist, or put together for retirement (or reside) then use PlannerPlus.

Personally, I believe each plans may have many nice options. I’ve examined each the free plan and the PlannerPlus plan (I personally have PlannerPlus now).

Bordin’s execs and cons

That is what I believe is the professionals and cons of Boldin:

Robust Factors:

- Straightforward to make use of monetary planning software

- Helpful visible charts and graphs

- Reasonably priced pricing and even free plans

- There isn’t any have to hyperlink your account

- Tremendous customized goal-based

Cons:

- If you wish to add all the knowledge, it might appear overwhelming at first. However I believe it is fairly straightforward so as to add the whole lot!

- There isn’t any cell app. For me, I do not thoughts about this, however if you wish to apply it to your cell phone you will have to log in by way of an web browser as an alternative.

FAQ

Beneath are the solutions to some normal questions on Boldin.

Is Boldin Planner Plus value it?

Sure, I believe Boldin’s PlannerPlus is value it for those who’re critical about planning your retirement. Whereas the free model is a superb place to get began, PlannerPlus has entry to extra highly effective options that really make a distinction, reminiscent of tax technique modeling, loss conversion instruments, actual property planning, and detailed What-IF eventualities.

For instance, eventualities reminiscent of completely different budgets (pre-retirement, early retirement, late retirement, and many others.), loss transformation of the mannequin may be modeled to mannequin relocation of main residences (you may see that downsizing or relocating to different states can have an effect on retirement).

Different advantages of Planner Plus embrace customizing assumptions reminiscent of inflation and property valuation, altering or including property possession (just like the second house), constructing detailed budgets that regulate over time, evaluating types of a number of retirement eventualities, modeling state-specific tax methods, and printing detailed plans.

Additionally, you will have entry to reside courses the place you may ask questions and get assist. At $12 a month or $144 a yr, that is an inexpensive approach to achieve extra management over your future and make smarter selections. If you’re excited about quitting or have already retired, PlannerPlus might help you’re feeling extra assured and ready.

Do I have to hyperlink my account?

No, if you don’t need it, you need not hyperlink your account to Boldin. You may manually enter the whole lot if vital.

Does Boldin work for a pair?

sure! It will possibly mannequin one or two folks’s plans, making it perfect for joint planning.

Is Boldin higher than Empower?

Boldin and Empower are completely different and so they serve completely different functions, so it actually depends upon what you want. Empower (previously private capital) is ideal for monitoring your web value and taking a look at your investments. Should you’re centered on funding administration and wish to have a look at your web value, it is a good dashboard.

Boldin, in the meantime, focuses on the plan. It helps you contemplate while you retire, tax methods, retirement spending, healthcare prices, and extra. Should you perceive your future monetary scenario and wish to actively plan it, Boldin is an effective selection.

In reality, many individuals use each instruments collectively. Empower for funding monitoring and Boldin for retirement plans. That means you’re going to get the most effective of each worlds.

Can I exploit Boldin with Monetary Advisor?

Sure, many Boldin customers share their plans with their advisors or use them to information monetary planning conferences.

Is Boldin straightforward to make use of?

I discovered the Boldin to be very straightforward to make use of. You may set it up in only a few minutes, or spend hours and truly diving in all of the completely different options. It actually depends upon what you are in search of.

Is Boldin protected to make use of?

Sure, Boldin is protected to make use of. Boldin makes use of bank-level encryption and follows strict knowledge privateness requirements. You may as well use the platform with out linking your precise financial institution or funding account. This implies you may keep management and enter the whole lot manually if vital.

Why did the brand new retirement change to Boldin?

The corporate modified its title from New Tirement to Boldin in 2025, higher reflecting its mission. The brand new title, Boldin, comes from the concept of serving to folks retire and turn into daring. The title has been modified, however the instruments are the identical.

Boldin Evaluation – Abstract

I hope you loved my Boldin evaluation.

So is Boldin value it?

Sure, for those who’re getting ready for retirement or already there, I believe Boldin is likely one of the finest instruments on the market. It can make it easier to reply massive questions and offer you actual peace of thoughts.

I believe it is nice for planners like me who continuously run eventualities on their heads and spreadsheets. It is nice that the whole lot is laid out on an easy-to-use platform that routinely generates graphs and sensible suggestions for you.

I personally plan to keep up the subscription I began and check with it frequently.

Boldin will make it easier to:

- It will likely be extra organized

- Set monetary objectives

- See what actions you may take to higher handle your cash, or retire earlier than

- Make knowledgeable selections

extra.

If you’re prepared to regulate the long run, we extremely suggest testing.

Click on right here to attempt Boldin at no cost.

Have you ever used Boldin? Do you want constructing retirement plans with instruments like this, or do you follow spreadsheets and monetary advisors?

Be aware: To guard my privateness, the picture on this Boldin evaluation will not be my private funds. They have been both offered by Boldin or created with one other take a look at account I created.

I like to recommend studying:

(TagStoTRASSLATE) Cash Administration (T) Resignation