Are you questioning if Empower is the fitting device that can assist you monitor your web value, funds and funding? this Empower Evaluate Decompose the whole lot it is advisable to know.

Monitoring your cash can really feel overwhelming, particularly when you could have a number of financial institution accounts, bank cards and investments. That is why I really like utilizing monetary instruments and cash apps that assist simplify the method.

Top-of-the-line free websites for managing your funds in a single place is Empower (previously generally known as Private Capital).

I first reviewed particular person capital years in the past, and ever since, they’ve been rebranded to Empowerment. They nonetheless have a well-liked free monetary dashboard.

On this overview we’ll cowl the whole lot it is advisable to find out about Empower. For instance, the way it works, who’s greatest, whether or not it’s value utilizing, and many others. We additionally share private experiences and a few tricks to take advantage of the free instruments offered by Empower.

To make use of Empower without cost, click on right here.

My Empower Evaluate

Beneath, I’ll study what I take into consideration this fashionable monetary planning device.

What’s Empower?

Empower is a monetary providers firm that gives the free Private Dashboard Monetary Monitoring Device and helps over 18 million individuals. Whether or not for honeymoon or retirement, Empower will help you save smarter and spend higher.

The platform provides a whole monetary snapshot by permitting all of your financial institution accounts, bank cards, loans and funding accounts to be linked to 1 place.

Empower is greatest:

- Somebody who needs to trace their web value with no spreadsheet.

- A funds man needs to see the place his cash is heading.

- Traders who wish to analyze charges and portfolio efficiency.

- Folks planning their retirement and in search of forecasts based mostly on precise knowledge.

Empower additionally provides Wealth Administration Providers, a paid monetary recommendation service for customers over $100,000 on investmentable belongings. Nevertheless, you do not want to enroll to make the most of the free instruments.

I like to recommend studying: Methods to Save for Retirement – Solutions to 13 of the Most Frequent Questions

How does empower assist the common particular person?

“Is Empower helpful if I am not investing in so much?”

The quick reply is sure. Even when fiscal administration is simply starting, empowering:

- As an alternative of checking a number of apps, you may monitor all of your cash in a single place.

- Budgeting instruments present you precisely the place your cash goes every month.

- You may higher perceive your money movement – herald how a lot you’re spending.

- You will discover hidden funding charges that may price hundreds over time.

- Resignation planners will help you set targets and see in case you are on monitor.

Whether or not you are attempting to repay your debt, make investments smarter, or plan for retirement, Empower will help you perceive your funds.

How does Empower work?

To begin empowering, listed below are some issues it is advisable to do:

- Join a free account on the Empower web site.

- Hyperlink monetary accounts, together with checks, financial savings, bank cards, loans, investments, and extra.

- Empower robotically pulls in monetary knowledge and classifies transactions.

- View your web value, monitor your spending, analyze your investments, and analyze the whole lot else out of your private dashboard.

One among my favorites at Empower is that it robotically updates your account day by day. Subsequently, you do not want to manually enter transactions like in a spreadsheet.

Principal Instruments Out there with Empower

Beneath are the primary instruments out there on the Empower platform:

1. Free monetary dashboard

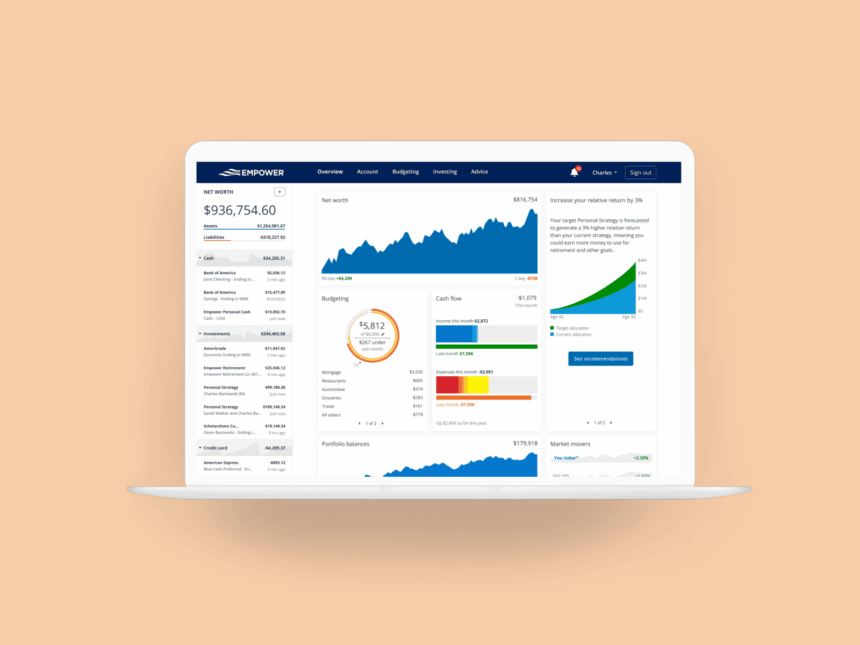

The dashboard is the place all of your monetary info could be gathered. As you may see:

- Your Internet Asset (Belongings vs. Liabilities)

- Your money movement (earnings and expenditure)

- Your funding stability and efficiency

- Tips about methods to enhance your funds

That is the perfect free community tracker I’ve discovered. I really like seeing the whole lot in a single place.

I like to recommend studying: What’s Internet Value? Methods to calculate web value

2. Finances preparation and money movement monitoring

The free empower budgeting device shouldn’t be as detailed as different budgeting instruments, nevertheless it’s nice for your spending total.

- Routinely classify transactions

- I monitor my month-to-month money movement so I do know for those who’re spending an excessive amount of

- It reveals how a lot you spend on totally different classes equivalent to groceries, eating places, purchasing, and many others.

3. Funding inspection

If in case you have an funding account, EMPOWER’s free funding testing device could be helpful to your evaluation.

- How nicely your portfolio works

- Are they diversified appropriately?

- If the price is simply too excessive

4. Resignation planner

One among Empower’s most attention-grabbing free instruments is the Retirement Planner. It’s going to assist you:

- Test in case you are on monitor for retirement based mostly in your present financial savings charge.

- Take a look at totally different situations (early retirement, elevated financial savings, and many others.).

- Plan main monetary occasions equivalent to shopping for a house or having kids.

- There’s even a simulator of a recession, so you may see how your retirement plans have been affected by the recession’s impression (e.g. 2008).

I believe this can be a useful gizmo because it makes it straightforward to see how totally different actions have an effect on you.

5. Retirement Analyzer

Many individuals do not perceive how a lot they lose to their funding charges. Free Empower Retirement Analyzer:

- It reveals how a lot you’re paying to your 401(ok), IRA, and different retirement accounts.

- Calculate how charges have an effect on your financial savings over time.

- If the value is simply too excessive, it would assist you discover a decrease price different.

That is a straightforward technique to save hundreds of {dollars} over time with out making any main adjustments.

6. Empower Wealth Administration (Paid Service)

Empower’s wealth administration providers goal individuals over $100,000 in investmentable belongings. When you select to enroll, you’ll get:

- A devoted monetary advisor that can assist you develop your plans

- Resignation Planning Assist

extra.

That is costly and relies on the stability.

I personally do not use this service as I handle the whole lot myself. And I like to economize this fashion as an alternative of paying percentages (this may make some huge cash over a lifetime!).

If you’d like the free monetary dashboard above and different instruments, you do not want to join this service.

Additionally, in case your Empower Dashboard lists over $100,000, you are prone to obtain a name from Empower asking if you wish to enroll. Nonetheless, for those who do not want/want this service, you do not want to enroll. You may say no to them.

Some individuals might discover worth on this service – it simply relies on what you’re in search of.

Professionals and Cons of Empower

Beneath are the benefits and drawbacks of Empower:

Robust Factors:

- Free to trace web belongings and spending

- Good for investing and retirement planning

- Helps you determine hidden charges to your funding

- Straightforward to make use of dashboard with helpful pictures see the way you do it

Cons:

- Empower’s monetary advisors can attain out to you when linking belongings of greater than $10,000 (some individuals might discover this annoying, but when you do not need to join this, you may merely inform them you are not ). I am positive I’ve obtained two or three calls over time, however not many.

- Budgeting instruments aren’t as detailed as different apps.

- Some individuals is probably not used to linking accounts.

Methods to begin empowering

It is easy to start out empowering. solely you:

- Join a free account right here.

- Hyperlink your monetary account and take full cash pictures.

- Begin monitoring your web value, spending and investments immediately!

Incessantly Requested Questions on Empower

Beneath are the solutions to common questions on empowerment.

Is Empower secure to make use of?

sure! Empower makes use of bank-level encryption and two-factor authentication to maintain your knowledge safe. They cannot transfer your cash – they simply preserve monitor of it. I personally related and added my data to the Empower dashboard, so I belief it.

Does Empower price cash?

The monetary dashboard is 100% free. When you select their asset administration providers, you can be charged a price. I personally select to not pay as I do not use their asset administration providers.

Is Empower an excellent app?

Sure, it is likely one of the greatest free monetary monitoring instruments out there. Many customers (together with me) adore it with web value monitoring and different options.

What are some widespread Empowered complaints?

Some customers don’t like Empire Advisors to contact upsell wealth administration providers in the event that they hyperlink over $10,000. Additionally, those that need extra budgeting instruments might imagine it is too primary when in comparison with instruments like YNAB.

Was Empower as soon as referred to as Private Capital? Why does it change?

sure! Empowered the private capital acquired in 2020 and rebranded it underneath one identify.

Is Empower value it? My final thought

I hope you loved my Empower overview.

When you’re in search of a free and straightforward technique to monitor your funds, you need to give Empower a attempt. Even when you do not have a big portfolio, budgeting, web value monitoring and retirement planning instruments could be extraordinarily helpful.

Personally, I really like with the ability to see all of your funds in a single place with out having to manually enter the info. It is a fantastic device to remain above your cash and make smarter monetary selections.

To make use of Empower without cost, click on right here.

Have you ever used Empower? Do you favor to make use of Excel sheets to handle your funds, or do you assume the instruments are higher?

Observe: To guard my privateness, the photographs on this Empower overview aren’t mine. They have been all offered by Empower.

I like to recommend studying:

(TagStoTRASSLATE) Cash Administration (T) Resignation